Tokenized assets bring traditional investments into a digital, more accessible format.

- Diversify Your Investments:Move your portfolio across different asset classes while remaining in an on-chain environment.

- Fractional Ownership:Purchase smaller shares of high-value assets.

- 24/7 Market Access:Trade anytime, unrestricted by traditional market hours.

- Enhanced Liquidity:Tokenized assets improve liquidity, making it easier to buy and sell.

- Security and Transparency:Transactions are conducted on a secure blockchain with built-in compliance.

In all, it provides a robust foundation for secure and compliant asset trading.

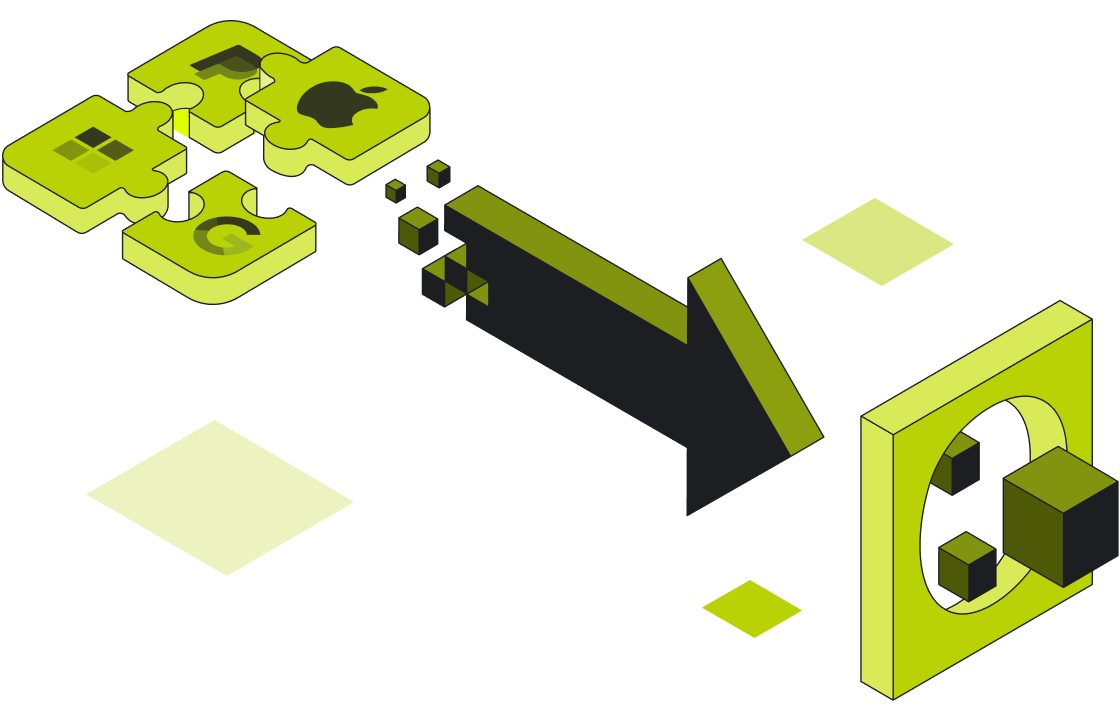

In addition, SoloTex leverages

To further enhance security, SoloTex employs

Finally, as a regulated platform operating under